Success in trading involves much more than understanding charts, indicators or economic news. While technical skills are certainly vital, it is often the psychological component that separates consistently profitable traders from those who struggle. The emotional roller coaster that comes with trading financial markets can lead to irrational decisions, even when a trader has a sound strategy. Understanding the psychological side of trading is therefore essential for anyone serious about long-term success.

One of the most important psychological challenges traders face is managing emotions such as fear and greed. Fear can cause hesitation or premature exits from trades, while greed may prompt overtrading or ignoring risk management rules. These emotional patterns often become more pronounced during periods of high volatility or after a string of losses or wins. Recognising these tendencies is the first step in developing greater emotional discipline.

Another common issue is the tendency to seek validation through market outcomes. Traders may equate a winning trade with skill and a losing trade with failure, even if both were executed correctly according to their plan. This kind of outcome-based thinking can be detrimental, leading traders to abandon effective strategies due to short-term results. Instead, focusing on process over outcome helps maintain consistency and reduces the emotional impact of individual trades. This is a key principle in psychology for traders, which encourages a more structured and self-aware approach to market participation.

Equally significant is the role of patience and discipline. Markets often require traders to wait for ideal setups, and acting too soon can result in poor entries and unnecessary losses. Patience is not simply about waiting but about maintaining focus and clarity during times of inactivity. Discipline, on the other hand, involves adhering to a trading plan, even when the temptation to deviate is strong. Together, these traits help traders stay aligned with their long-term objectives.

Cognitive biases also play a substantial role in trading decisions. Confirmation bias, for example, can lead traders to favour information that supports their existing views while ignoring contradictory data. Similarly, the sunk cost fallacy may cause them to hold losing positions longer than they should, simply because they have already invested time or money. Awareness of these biases, along with strategies to counteract them, is crucial in refining decision-making processes.

Developing a trading journal is one practical way to address psychological challenges. By recording entries, exits, and the rationale behind each trade, traders can identify emotional patterns and behavioural tendencies that may be affecting their performance. Over time, this habit can lead to improved self-awareness and more objective decision-making. Journaling also offers the added benefit of reinforcing successful behaviours and highlighting areas for improvement.

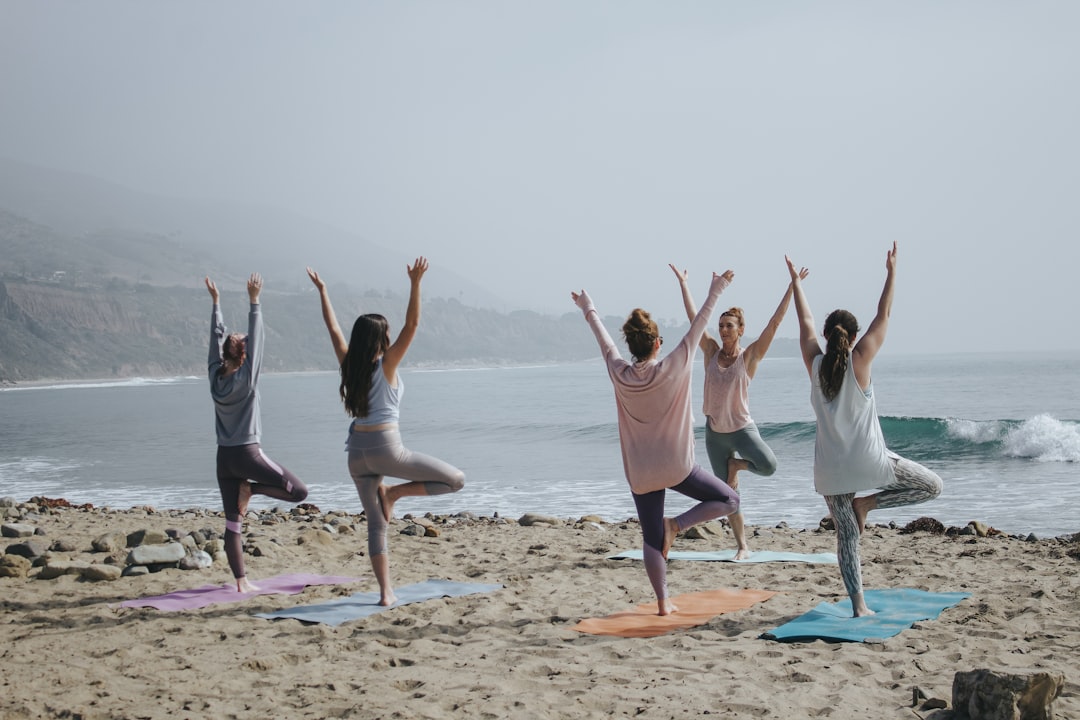

Traders who treat the market as an environment for self-development often find greater satisfaction and resilience. By prioritising mental clarity, emotional control and psychological preparedness, they can better handle the inevitable ups and downs of trading. Training the mind to remain calm and objective under pressure is not a quick fix but a continual effort, much like physical training. The more a trader invests in their psychological development, the more likely they are to perform with consistency and confidence.

For those looking to deepen their understanding of trading psychology, working with mentors or participating in structured learning environments can be highly beneficial. These avenues provide not only technical insights but also support in navigating the emotional challenges of trading. Maintaining a connection with a trading community can also help reduce feelings of isolation and offer perspective during difficult periods.

To further explore how to build a strong mental framework for trading, consider learning more through comprehensive trading education tailored to developing both skill and mindset. By integrating psychological principles into their routines, traders can enhance not only their performance but also their overall experience in the markets.